Connecting payments

Skyrocket your business profits rapidly by using a new cost-effective payment generation system.

How does it work?

Choose an Account

To help you get started quickly and easily, we offer a variety of pricing plans.

Apply in Minutes

With our customizable dashboards, you can easily fill-in our onboarding form.

Get

Started!

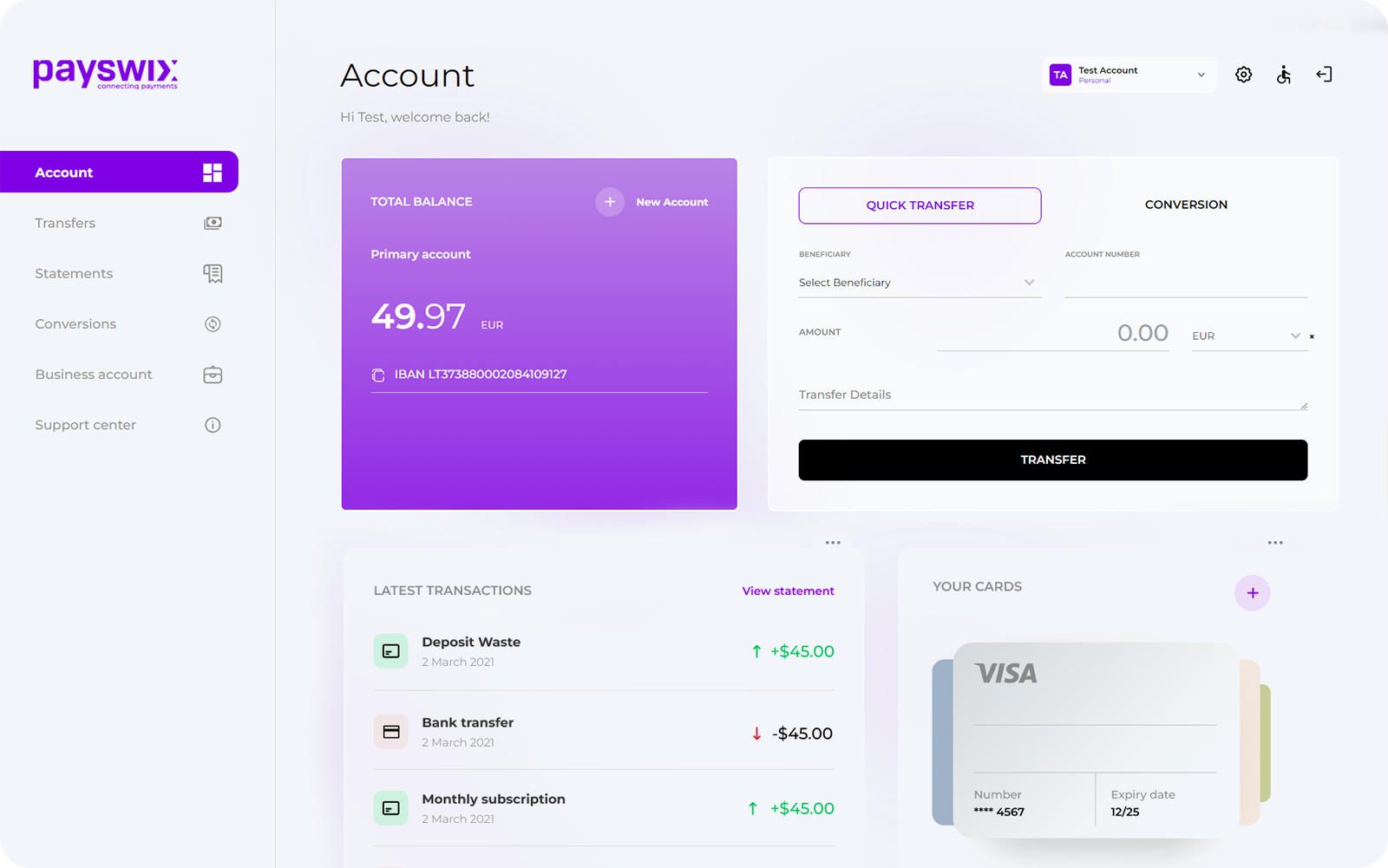

You can view your data and fulfil all your financial needs from the comfort of your own home.

Built-in Services

Explore numerous possibilities and solutions for your financial needs. You can send, receive, exchange, accept, and much more in one place.

Named IBAN Accounts

Dedicated IBAN's for Crypto Exchange users

Correspondent banking

Acquiring

and

Merchant Services

SWIFT &

SEPA

Payments

Business financing

Referral program

Full API

integration

Two Factor

Authent.

Agent Program

Correspondent banking

Named IBAN Accounts

SWIFT & SEPA Payments

Referral program

Acquiring and Merchant Services

Full API integration

Two Factor Authent.

Request a meeting with our Sale Representative: Shedule a call or fill contact form

Pricing plans

tailored for you

Business

- Multicurrency account opening (plus one EUR IBAN included)

- Account Monthly fee - 9 €

- SEPA payments - from 1 €

- SWIFT payments - 25 €

BUSINESS PLUS

- Multicurrency account opening

(plus one EUR IBAN included) - Account Monthly fee - 59 €

- SEPA payments - from 3 € + 0.1%

- SWIFT payments - 25 € + 0.2%

BUSINESS EXCLUSIVE

- Multicurrency account opening

(plus one EUR IBAN included) - Account Monthly fee - 99 €

- SEPA payments - from 3 € + 0.2%

- SWIFT payments - 30 € + 1%

The pricing is assigned if the company or individual business is EEA based and the business activity is related to:

- E-Commerce trading

- Retail trading

- Taxi/Buss services

- Accommodation (hotels) services

- Restaurants and bars

- Import/export

- Handcrafting

- Manufacturing

- Agriculture

The pricing is assigned to all clients who do not match ‘Business’ requirements and the business activity is related but not limited to:***

- Media, Affiliates

- Online Advertising

- Marketing

- Accountancy

- Legal or notary practice

- Tax advisors and accountants

- IT development

- Intermediary services

- Precious/rare metals

- Jewelery and arts

- Audit services

- Delivery of future services including airlines

- Travel agencies and hotel bookings

- Logistics

The pricing is assigned to all clients who do not match ‘Business’ and ‘Business Plus’ and the business activity is related but not limited to:

- Forex

- Activities involving gambling

- Casino games

- Lottery

- Crypto-related

- PSP

- Financial services

- Money transfer services

- Insurance

- Real Estate

- Well known dating sites

EU/EEA

- Multicurrency account opening

(plus one EUR IBAN included) - Account Monthly fee - 3 €

- SEPA payments - from €0

- CHAPS, BACS, Target 2 - from €3

Fees may vary from those provided at the sole discretion of Payswix.

Book a Meeting with Our Sales Team

Partner with us to streamline your business strategies and elevate the quality of your financial services.

Meet Us

There

17/18

iGB L!VE connects igaming operators, affiliates, tech vendors and game providers in a live environment in order to create strong, trust-based partnerships that will drive business growth and secure competitive advantage.

The meeting place for the world’s top

affiliate marketers and ecommerce entrepreneurs

SiGMA is the global gateway to the online Gaming world.

20/22

The leading global gaming and gambling event servicing the entire industry.

Payswix

Storing and sending funds have never been easier, so apply for your account now.

is a payswix a licensed provider?

Yes, Payswix, UAB is an Electronic Money Institution, authorized by the Central Bank of Lithuania (No. 21) for the issuing of electronic money.

Is it safe to send money through payswix?

Of course. Your safety is one of our top priorities. We preach full transparency when it comes to our customers’ accounts and transactions; therefore, we will keep you informed about the status of your account as well as your payments.

What countries belong to SEPA?

The outgoing and incoming SEPA payments are available from/to Austria, Andorra, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Vatican City and Non-EEA Territories, namely, Saint-Pierre-et-Miquelon, Guernsey, Jersey, Isle of Man.